The Nigerian Exchange Group Plc (NGX Group) has stressed the need for the new government to focus more on policies that would boost liquidity and make the market friendly for investors.

Besides, the group also expressed optimism that President Bola Ahmed Tinubu administration would fasttrack the planned Initial Public Offer (IPO) of the NNPC Limited.

At the group’s 62nd yearly general meeting held in Lagos at the weekend, Group Chairman, NGX Group, Alhaji Umaru Kwairanga stated that the Federal government needs to implement market friendly policies that will engender consistent growth in the market and make businesses to thrive in Nigeria .

Also at the meeting, shareholders approved all resolutions on the agenda, which included the appointment of six Directors of Nigerian Exchange Group Plc: Mr Nonso Okpala (Non-Executive Director), Mr Sehinde Adenagbe (Non-Executive Director), Mr Ademola Babarinde (Non-Executive Director), Mrs Mosun Belo – Olusoga (Independent Non-Executive Director), Mr Mohammed Garuba (Non-Executive Director) and Mrs Fatima Wali- Abdurraham (Independent Non-Executive Director).

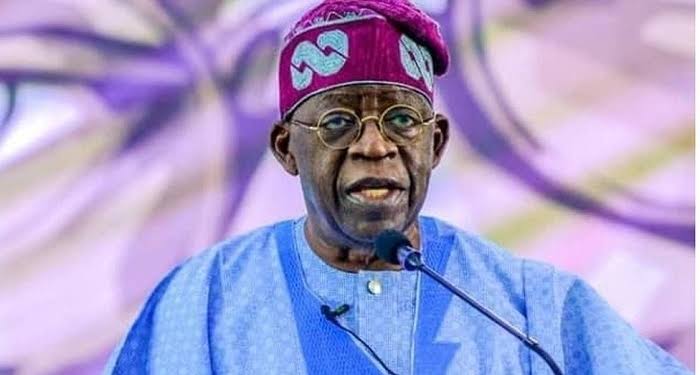

Kwairanga added that the group is hopeful that the planned Initial Public Offer (IPO) of the NNPC Limited will be fast-tracked by the Tinubu-led administration.

There has been a clarion call for multinationals in the telecoms, and oil and gas companies to list on the nation’s bourse, to deepen the market and encourage active participation of indigenous consumers in the companies’ wealth creation process.

It is not heartwarming to say that the Nigerian capital market, relative to the size of the country’s economy, is still abysmally low, as the market capitalisation to GDP ratio stands far below 20 per cent, in contrast to South Africa’s 348.3 per cent and Brazil’s 68.4 per cent.

The ratios in the key developed economies are more than 100 per cent. The participation of Nigerians in the capital market is very low. Less than five per cent of the country’s population are involved in the market as investors, while less than one per cent of registered companies are listed.

This is despite various initiatives put in place by the regulators to restore investors’ confidence and attract more issuers to the market.

Notably among them being the establishment of the National Investors Protection Fund, to cushion the adverse effect of losses suffered in the capital market, the e-dividend policy designed to minimise cases of unclaimed dividend.

The regulators have provided issuers and investors with a responsive, fair and efficient securities market, using cutting-edge technology, and providing local and foreign investors access to the Nigerian securities market in an environment of a strong regulatory framework and reliable trading and settlement systems.

The NGX currently has a more attractive portfolio of services and products, although investors have maintained a strong appetite for equities.

Experts have argued that investors’ confidence in the market would remain low until the government focused more on policies that would boost liquidity and make the market thrive for both local and foreign investors.

According to Kwairanga, the group is open to working with the Federal government, as well as stakeholders towards improving the country’s credit profile and creating a favorable environment for both domestic and foreign investors.

He lauded President Tinubu-led administration for the various reforms that have resulted in the impressive performance witnessed in the market in the past few months.

“The capital market community is excited by the new government and the steps it has so far taken with respect to the economy as reflected in the tremendous growth in our market indicators.

“As a group, we are committed to working with the government to stimulate further growth in the economy, address higher capital costs, as this will go a long way to enhance Nigeria’s credit profile, and create a favourable environment for both domestic and foreign investors”, he said.

Speaking on the performance of the group, Kwairanga noted that NGX Group demonstrated resilience in 2022, achieving a 10.3 per cent increase in gross earnings to N7.5 billion, despite a challenging economic environment.

The group’s total revenue grew primarily due to a 6.8 per cent increase in revenue to N6.2 billion, and a 30.1 per cent increase in other income to N1.3 billion.

According to him, revenue growth was further bolstered by a 51.2 per cent increase in treasury investment income and 9.0 per cent rise in transaction fees. However, its total expenses rose by 35.5 per cent to N8.8 billion, primarily due to interest costs on borrowed funds used for strategic acquisitions.

While welcoming the new board members, Kwairanga also commended the contributions of the outgoing board members to the growth and development of the organisation.

He said : “Achieving an efficient capital mix and broadening our access to capital remain fundamental to our mission. The board will continue to assist the management team in addressing long-term risks, strengthening the global NGX brand, and assessing progress toward our goal of being Africa’s preferred exchange hub.”

Group Chief Executive Officer, Oscar Onyema, said the performance reflects NGX Group’s commitment towards driving growth in Nigeria and Africa’s capital markets.

Onyema stated that the group is proud to have generated multiple income streams that enabled it to overcome economic headwinds while stressing the group’s commitment to leverage its strengths and expertise to drive growth and value creation in Nigeria and other financial markets Africa.

“NGX Group will continue supporting its operating subsidiaries, associates, and investee companies to deliver sustainable value creation for its shareholders. We will look to enhance our performance by continuously striving to optimize operations, increase revenue streams and expand our market reach.