By David Akinmola

Despite the insecurity in the country and other macroeconomic challenges, coupled with uncertainty in the global economy, stock market investors gain N2.081 trillion in November.

A review of market performance last month indicated that the Nigerian Exchange Limited (NGX) benchmark All-Share index gained 8.72 percent, making it the best monthly performance since May 2022.

The index halted the bearish trend, although on a low traded volume, appreciating higher than the N2.7 trillion losses recorded in October, signaling an uptrend and a relative return of the bull to the market.

Analysts argued that investors leveraged opportunities in the low equity prices arising from the losses of the past few months, and the resultant higher dividend yields ahead of year-end seasonality.

This also followed the demand for high-priced stocks that had suffered losses before now, especially telecommunication and industrial goods stocks. Particularly, positions were taking in the shares of Airtel, MTNN, Dangote Cement, BUA Cement, and others, which combined to lift the market capitalisation.

Last month, basic indicators of the NGX, All-Share Index gained 8.72 per cent to close on November 30, 2022, at 47,660.04 basis points, from 42,716.44 points at which it opened for the month.

Similarly, market capitalisation for the period rose by N2.081 trillion to close at N25.959 trillion as of November 30, 2022, from N23.878 trillion at which it opened trading for the month.

Despite, the mixed economic data, rising inflation and rate hike by the Central Bank of Nigeria (CBN), impressive third quarter (Q3), 2022 corporate earnings reports, shorter time frame to achieve double-digit returns for fixed income market instruments and bargain hunting sustained investors repositioning for higher dividend yields in equities assets.

The index chalked 8.72 per cent, almost recovering all of the 10.58 per cent lost in October.

Meanwhile, the sectoral performance indices closed mixed. For instance, the NGX Industrial, Premium, NGX 30, Main Broad, and Banking gained 13.17 per cent, 11.67 per cent, 8.57 per cent, 6.21 per cent, and 4.94 per cent respectively.

On the other hand, Oil & Gas led the decliners after losing 8.44 per cent, followed by Consumers goods with a 4.91 per cent decline.

November’s best-performing stocks were Unity Bank, which gained 23.91 percent on market sentiment.

NEM Insurance followed on its impressive Q3 numbers and a small share in issue after its share price appreciated by 20 percent, while the Nigerian Exchange Group rose 18.98 per cent for the month.

On the other hand, the worst-performing stock was SCOA, which lost 39.43 per cent of its opening price for the month. Guinness Nigeria shed 24 percent on unimpressive Q1 earnings performance, while SUNU Assurance dipped by 22.86 per cent in November.

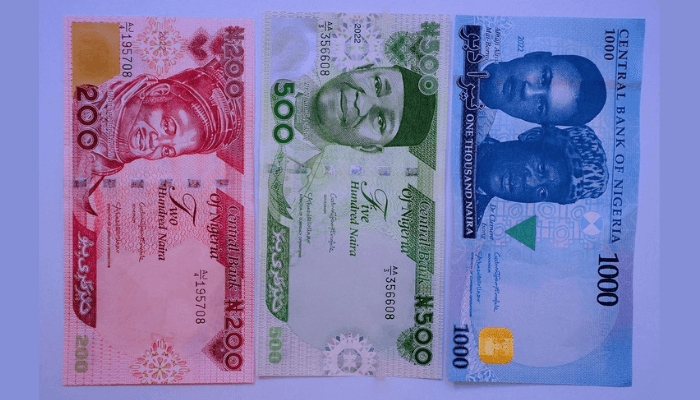

Speaking on the stock market performance, vice president, of Highcap Securities, David Adonri attributed the increase to CBN’s redesign of the naira, stressing that some high-network investors opted to invest in the stock market.

According to him, the improved performance in November was due to the CBN’s redesigning of the Naira,.as most of the economic factors were negative.

” One can suspect some rich investors have channeled their funds through the stock market to beat CBN’s policy. The macroeconomy is in total disarray considering a hike in inflation, flood disasters, and tension toward the 2023 general elections. Also, in November, there were many debt offers by Debt Management Office (DMO) including Sukuk,” he said.

On market outlook, Chief Research Officer of InvestData Consulting Limited, Ambrose Omordion said: “We expect a bull run, as traders and investors interpret happenings in the global market, fixed income yield environment, earnings report and economic data, coupled with portfolio repositioning ahead of the December seasonal trends and expectations in the midst financial market reset.

“This is given that oil price in the international market has continued to oscillate and the smart money is trying to rotate their positions as dividend yields are attractive at this point.”

According to him, profit-taking is imminent, being a regular behavior of stock markets, as any price correction at this phase of market recovery will support the upside potential.

He added that this is inevitable as many fundamentally sound stocks remain underpriced, while the dividend yields of major blue chips continue to look attractive, despite the recent rally.