The Nigerian investment landscape maintained positive profits for investors in 2023, from the various capital market instruments to mutual funds.

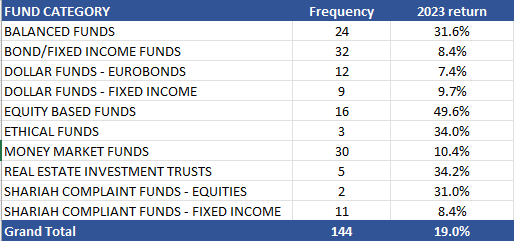

According to the data from the Securities Exchange Commission (SEC), the mutual funds in Nigeria printed an average of 19 per cent return in 2023.

Further analysis showed that equity-based funds recorded the highest return of 49.6% compared to other mutual funds. This is in line with the performance of the Nigerian stock market, which gained 45.9% in 2023 and has continued its rally in 2024, gaining 26.43% year-to-date.

Similarly, Real Estate Investment Trusts (REITs) followed with a gain of 34.2 per cent, ethical funds (34%), while balanced funds printed a 31.6 per cent return. In terms of the best-performing mutual fund for the year, Stanbic IBTC Asset Management’s UPDC Real Estate Investment Trust led the pack with 113.33%.

Best-performing balanced funds

A balanced fund is a type of mutual fund that usually includes both equities and bonds. Balanced funds often follow a specified asset allocation of stocks and bonds, such as a 70/30 stock and bond ratio.

According to the SEC, there were 24 balanced funds listed as of 29th December 2023, recording an average return of 31.6%. All the balanced funds recorded positive returns in the review year, except for Core Value Mixed Fund, which closed flat.

1st: ValuAlliance Value Fund

Fund Manager: ValuAlliance Asset Management Limited

Return: 83.34%

2nd: FBN Balanced Fund

Fund Manager: FBNQuest Asset Management Limited

3rd: Women’s Balanced Fund

Fund Manager: Chapel Hill Denham Management Limited

Return: 45.54%

Best-performing bond/fixed-income funds

Bond/fixed-income funds are mutual funds that invest in a portfolio of debt instruments issued by governments, corporations, and other organizations. FGN bonds, State government bonds, Eurobonds, Corporate bonds, and maybe additional instruments like Treasury Bills and Commercial papers are examples of these instruments.

There were 32 bond or fixed-income funds registered with the SEC as of the end of December of 2023 printing an average year-to-date return of 8.4%. All the funds in this category recorded positive returns in the period under review.

1st: Stanbic IBTC Conservative Fund (Sub Fund)

Fund Manager: Stanbic IBTC Asset Management Limited

Return: 24.6%

2nd: DLM Fixed Income Fund

Fund Manager: DLM Asset Management Limited

Return: 14.4%

3rd: Nigeria International Debt Fund

Fund Manager: Afrinvest Asset Management Limited

Return: 13.46%

Best-performing dollar funds

Dollar funds are divided into two categories, Eurobonds and fixed income. A dollar mutual fund has a moderate to medium risk profile and consistently generates income by investing in debt instruments denominated in US dollars, such as fixed income and Eurobonds.

According to the SEC, there were 21-dollar funds registered as of the review period, which recorded an average of 8.5% return. Just like the bond/fixed income instrument, all the funds in this category recorded positive returns in 2023.

1st: Nova Dollar Fixed Income Fund

Fund Manager: Novambi Asset Management

Return: 19.69%

2nd: AVA GAM Fixed Income Dollar Fund

Fund Manager: AVA Global Asset Managers Limited

Return: 17.98%

3rd: Futureview Dollar Fund

Fund Manager: Futureview Asset Management Limited

Return: 14.16%

Best-performing equity-based funds

Equity-based mutual funds are professionally managed pools of investment vehicles primarily comprising of stocks. The mutual fund may be designed for a specific industry or index, and it could choose from the list of quoted shares in the stock market, depending on the approach it uses.

It is worth noting that all 16 listed equity-based mutual funds returned double-digit growth in the year under review, which underscores the recent performance of the Nigerian stock market. The equity-based mutual fund recorded an annual average return of 49.62%

1st: Futureview Equity Fund

Fund Manager: Futureview Management Limited

Return: 86.02%

2nd: Stanbic IBTC Aggressive Fund

Fund Manager: Stanbic IBTC Asset Management Limited

Return: 66.35%

3rd: Afrinvest Equity Fund

Fund Manager: Afrinvest Asset Management

Return: 64.39%

Best-performing ethical funds

Ethical funds are mutual funds where investment decisions are made after taking into consideration some agreed ethical factors. Such factors can be set from a religious, environmental, social, governance, or other moral perspective.

There were only 3 ethical mutual funds, all of which recorded positive returns in the period under review.

1st: Stanbic IBTC Ethical Fund

Fund Manager: Stanbic IBTC Asset Management Limited

Return: 44.44%

2nd: ESG Impact Fund

Fund Manager: Zenith Asset Management Limited

Return: 37.84%

3rd: ARM Ethical Fund

Fund Manager: Asset & Resources Management Company Limited

Return: 19.64%

Best-performing money market funds

Mutual funds that invest in debt instruments with short maturities and little credit risk are known as money market funds. Specifically, they are among the least volatile investing options. Depending on the securities the money market fund invests in, the income it generates may be taxed or exempt from taxes.

As of the end of December 2023, 30 money market funds were registered with the SEC. They recorded an average return of 10.4% in the review period. Also, all the funds classified as money market funds printed positive returns in the review year.

1st: AIICO Money Market Fund

Fund Manager: AIICO Capital Limited

Return: 14.24%

2nd: Trustbanc Money Market Fund

Fund Manager: Trustbanc Asset Management Limited

Return: 14.05%

3rd: Emerging Africa Money Market Fund

Fund Manager: Emerging Africa Asset Management Limited

Return: 13.33%

Best-performing Real Estate Investment Trusts

A company, trust, or organization that makes direct real estate investments through mortgages or properties is known as a real estate investment trust (REIT). They are bought and sold like stocks and traded on a stock exchange.

1st: UPDC Real Estate Investment Trust

Fund Manager: Stanbic IBTC Asset Management Limited

Return: 113.33%

2nd: Union Homes REITS

Fund Manager: SFS Capital Limited

Return: 34.24%

3rd: SFS Real Estate Investment Trust Fund

Fund Manager: SFS Capital Limited

Return: 13.63%

Best performing Shariah Complaint Funds

Shariah-compliant funds are investment funds governed by the requirements of Shariah law and the principles of the Islamic religion. Shariah-compliant funds are considered to be a type of socially responsible investing.

1st: Stanbic IBTC Imaan Fund

Fund Manager: Stanbic IBTC Asset Management Limited

Return: 43.84%

2nd: Lotus Halal Investment

Fund Manager: Lotus Capital Limited

Return: 18.16%

3rd: FBN Halal Fund

Fund Manager: FBNQuest Asset Management

Return: 13.22%