The Israeli-Hamas conflict can lead to oil price volatility in the Middle East, impacting Nigeria’s oil revenues and causing potential fluctuations in its foreign exchange reserves.

The war might disrupt Nigeria’s trade relations with Israel and affect global economic sentiment, resulting in reduced foreign direct investment and possible depreciation of the Nigerian naira.

The conflict could inspire extremist groups in Nigeria, escalating regional tensions, and leading to travel advisories that affect business and tourism between Nigeria and affected regions.

On the morning of Sunday, October 8th, 2023, the Palestinian militia group, Hamas, unexpectedly attacked Israel, resulting in the abduction of over a hundred individuals and the death of more than 900 Israelis.

Israel swiftly retaliated, and the ensuing confrontations have claimed the lives of over 500 Palestinians thus far with the figure expected to rise in the coming days and weeks.

Following the attack, Israeli Prime Minister, Netanyahu declared war against Hamas and initiated a siege on the Hamas-dominated Gaza Strip. Predictably, the US and most Western nations have denounced Hamas, labelling them as a terrorist organization.

Conversely, Iran and several supporters of the Palestinian cause attribute the conflict to Israel’s territorial expansion into Palestinian regions, its ongoing occupation of what they term “Palestinian land”, and alleged acts of apartheid.

These factors, they assert, are the primary triggers of the present conflict. Globally, opinions are sharply divided, with vocal critics and proponents on both sides suggesting various resolutions to the escalating crisis.

As the international community anxiously monitors the situation, potential economic repercussions loom large. These effects could particularly impact Sub-Saharan African nations, such as Nigeria, which is currently grappling with significant economic hurdles.

Oil Prices and Energy Markets: The Middle East is a major hub for oil production and trade contributing around 33% of global crude oil production.

Any prolonged conflict in the region can lead to volatility in global oil prices due to concerns over supply disruptions, even if Israel and the Palestinian territories are not major oil producers themselves. Initial reports indicate crude oil prices surged by 4% on Monday with likely indicators pointing to an ever-higher price.

Nigeria, being a major oil-producing country, could experience fluctuations in its oil revenues. If the conflict escalates to involve other Middle Eastern nations or causes disruptions in major shipping routes, there could be a significant impact on global oil prices.

An upward trend in oil prices could benefit Nigeria by increasing its oil revenue, but it could also increase costs for countries dependent on refined petroleum imports like Nigeria. Diesel prices are currently above N1,000/Liter and it is likely to keep rising if crude oil prices continue to increase.

Effect on the Exchange Rate: As previously mentioned, the Middle East is crucial for global oil dynamics. An escalation in conflict can potentially impact oil prices.

If oil prices rise and Nigeria’s oil exports benefit, there could be an influx of foreign currency, potentially bolstering Nigeria’s foreign exchange reserves. However, if for some reason oil exports are hindered or if the conflict causes a decrease in global demand, then Nigeria could see a depletion in its reserves.

A country’s foreign exchange reserves are directly linked to its currency’s strength. A depletion of these reserves can result in the depreciation of the local currency, the Nigerian naira, against major currencies like the US dollar.

Geopolitical uncertainties can influence investor sentiment as if global investors perceive heightened risks in emerging markets due to the Israeli-Hamas conflict or its potential spillover effects, there could be a decline in capital importation in Nigeria.

Reduced capital importation can put pressure on the naira, leading to potential depreciation.

Trade Relations: Nigeria, like many countries, maintains trade relations with Israel. While their trade volume isn’t massive, any prolonged conflict could disrupt trade ties or the ease of doing business between the two nations.

Companies that rely on imports or exports between Israel and Nigeria may experience delays, added costs, or reduced business.

Recent data from the NBS suggest Israel is not a major trading partner for Nigeria however, both countries experience trade in the areas of security, technology, and construction.

This war is likely to affect businesses in these sectors that rely on trade partnerships.

Global Economic Sentiment: The Israeli-Hamas conflict, especially if prolonged or escalated, can affect global economic sentiment, investor confidence, and risk perceptions.

Such conflicts can create uncertainties in global markets. Nigeria, being part of the global economy, could experience reduced foreign direct investment (FDI) or see a pullout of short-term portfolio investments from its markets.

Nigeria is currently experiencing one of its worst cycles of low foreign investment inflow and badly needs forex inflows to stabilize its exchange rate. But with the conflict likely to escalate, it is very likely that some of the countries such as the US, Saudi, India and the EU Bloc which Nigeria has been wooing for foreign investors will not view it as a priority.

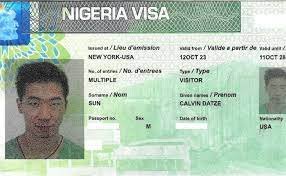

Diaspora and Remittances: While the Nigerian diaspora in Israel is not as large as in some other countries, there are still Nigerians living, working, and studying in Israel.

A prolonged conflict could affect their safety, and ability to work or send remittances back to Nigeria.

Reduced remittances, even if minor, can affect the Nigerian economy, especially the households dependent on these funds.

Terrorism and Security Concerns: The Israeli-Hamas conflict could embolden or inspire extremist groups in Africa, including Nigeria.

Groups such as Boko Haram or other regional extremist factions might find motivation in the conflict for their own purposes.

This could lead to an escalation in regional tensions or violence, which can have direct economic costs in terms of security provisioning, displacement of people, and disruption of economic activities especially in Northern Nigeria and the middle belt.

The last thing the current government needs is an escalation of insecurity from religious extremists who might see this war as a motivation to increase attacks locally. This will be a huge distraction for the current government as it has limited resources to embark on a protracted security crisis.

Travel Advisories and Restrictions: In light of conflicts, many countries issue travel advisories to their citizens, cautioning them against non-essential travel to affected areas.

Nigeria may issue advisories discouraging travel to Israel and the surrounding regions in the Middle East, impacting business, tourism, and personal travel.

Similarly, other countries, based on their assessment of the situation and possible retaliations, might issue advisories against travelling to Nigeria or other nations perceived to be at risk.