Economic experts have called on the Federal Government to take swift and deliberate action to cushion the effects of the disruption in the global wheat market on Nigeria’s wheat value chain.

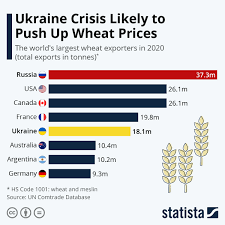

The analysts made the call in a published review on the global wheat market following the war between the two top wheat-exporting countries – Russia and Ukraine.

According to the analyses, the multifaceted value chain crises, including the shortage of foreign exchange, mounting freight charges and hike in the price of diesel, worsened by the war, continue to take a heavy toll on the wheat value chain.

Flour millers have continued to battle with the rising cost of production and low local wheat production. The rising costs have passed down to bakers as well as raise the hardship and cost of living index of the hard-pressed local consumers who continue to bear the burden of the increase in the prices of wheat derivative foods and household staples.

The experts said millers and bakers have come under intense cost pressure as the price of the all-important grain continues to skyrocket in the international market and freight charges have spiralled out of control.

The review showed that the price of wheat in the global market shot to $1,000 per bushel in March 2022 from $761.25 in January. Besides, the millers are expected to spend more on shipping the commodity from the exporting countries as their combined freight bill prediction jumped from N21.6 trillion in 2019 to N28.8 trillion in 2021.

The report said: “The demand for the wheat-based products being fairly price-elastic implies that the burden of every new rise in costs is primarily absorbed by the millers and bakers. The upward trend in the global wheat and freights costs continues to frustrate the millers, who have for long borne the cost burden to keep the retail price stable and avoid passing on the costs to the poor consumers, who rely heavily on wheat-derivative foods such as bread, which remains a significant part of their daily diet, in feeding their households.

“A basket of similar food commodities has increased in price by an average of over 50 per cent and bread prices have only increased by 30 per cent. The millers and bakers have borne the rest of the inflationary burden. Under the present circumstances, anyone can guess how much longer they can keep prices moderate.”

Citing urgent actions that must be taken to avert production and major food inflation crisis, the experts proposed the wider adoption of the agriculture value chain intervention model developed by the Senegalese government. The Senegal Agriculture Programme provides access to key inputs such as seeds, fertilizers, and technical and marketing assistance for local smallholder farmers.

Other measures proposed by the analysts to help the millers, bakers, and consumers included the removal of the 15 per cent cassava levy imposed on the importation of wheat grain, increased access to forex at the Import and Export (I&E) window allowance for tax concessions in line with the key backward integration programmes index and the provision of logistic support, among others, to the millers.

While calling for the removal of the 15 per cent cassava levy in a recent interview, the National Secretary-General of the Association of Master Bakers and Caterers of Nigeria (ABCON), Jude Okafor, said: “We had earlier made a plea to the government to cancel the 15 per cent wheat (cassava) levy.”

Notably, the 15 per cent cassava levy was meant to drive up local cassava production to the point of substituting cassava flour for wheat flour in most bakery production.

However, according to the experts, there has been no significant improvement in the cassava value chain since the introduction of the cassava substitution policy and the levy. Considering the crisis in Ukraine and the global food crisis, the experts called on the Nigerian government to reconsider the removal of the 15 per cent wheat import levy, as “this is necessary to prevent a wider supply chain breakdown and recession.”