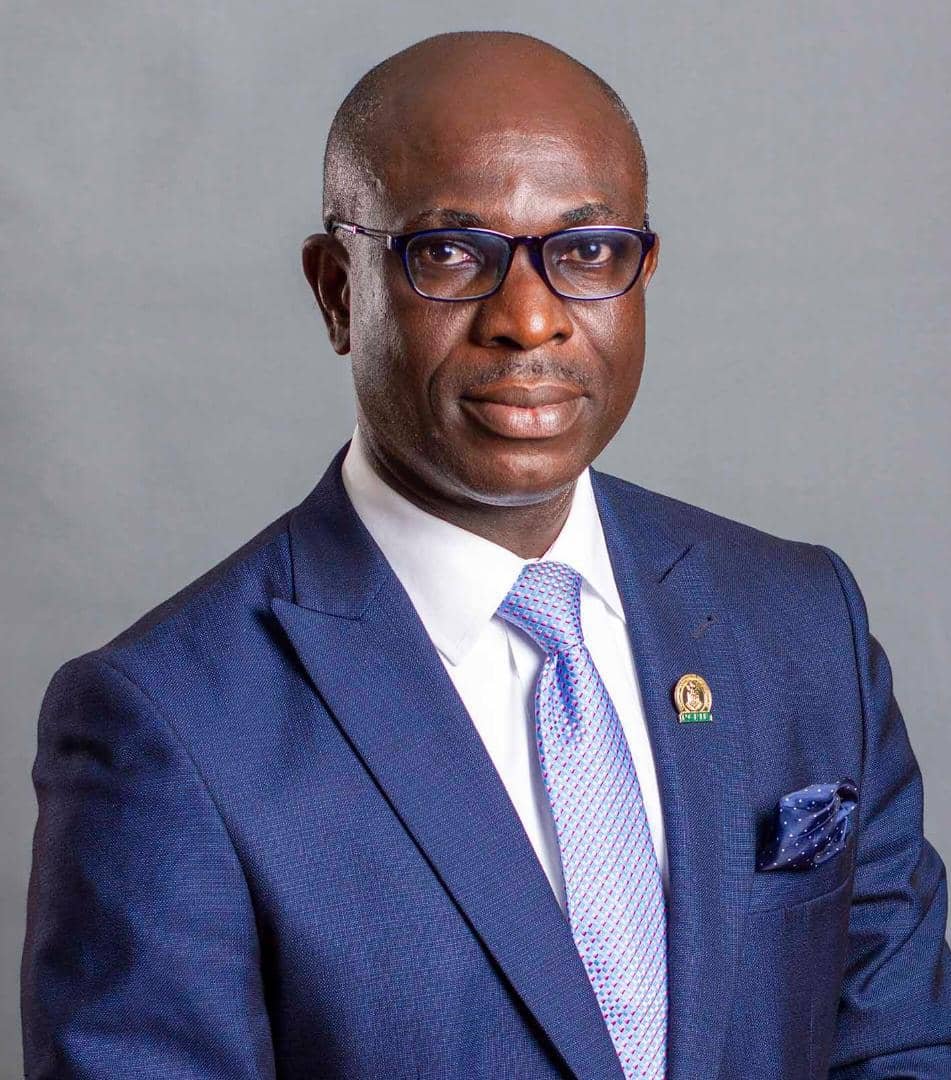

Tope Adaramola

Sam,( real name), graduated from a tertiary institution and many young Nigerians are disillusioned about how to secure a job. For quite a while he did all humanly possible but got no breakthrough. It was in the process of the goose chase that an uncle advised him to go the way of an entrepreneur which he agreed to. In a little while, he perfected the act of photography and chose a career path as an entrepreneur, rather than a salary earner. This also put a full stop to his endless search for elusive white-collar jobs.

With his digital professional camera, he covered social and sometimes official engagements, raking in income with which he hired a modest apartment while plowing the rest of his profit back into his photography business regularly.

It was in the course of plying his trade that he came across Madam Sola, a client of his, who introduced him to insurance and told him what he would gain by insuring his camera, which was the only means of his survival. Sam received the advice with the usual skepticism and wondered if insurance was for such “small things” as his camera. But due to the insistence of Madam Sola, he decided to heed the advice, not so much because he believed in insurance (having heard several noxious stories of it), but because he desired that his relationship with Madam Sola continued. Madam Sola collected a token from Sam and helped him to arrange what is called an All Risk Insurance, in an insurance parlance. As far as Sam was concerned, it was like throwing a coin into the ocean with no hope of seeing it anymore!

But as it would turn out, one day Sam was engaged to cover a marriage ceremony somewhere in the Ketu area of Lagos. The assignment spanned into the night. On his way back home, he was unlucky to have boarded a dummy commercial vehicle often referred to as “one chance”. At some point while in motion, the bandits asked him to surrender all he had on him, of which the camera was the most worthy. Sadly Sam disposed of the camera and other valuables. He became utterly sad and depressed. He reasoned that life had come to an end, wondering where he was going to pick up the pieces again. But not long to the day of the incident, Madam Sola needed Sam to cover an event in her church and invited Sam over. On getting across to Sam, his voice reflected melancholy and dejection to which Madam Sola asked why. Sam narrated all that had happened and how hopeless he had become. “Come on Sam, why border yourself, I thought I assisted you to place that camera under cover!” blared out Madam Sola. “Yes, I think you did ma, but do you think that would mean anything now?’’ replied Sam.

Without Sam knowing, Madam Sola filled out a claim procedure with an insurance company and in three days, a cheque was issued in the name of Sam covering the cost of the camera. On being told to come over for the cheque, Sam was dumbly funded and started shouting “So this insurance real?” Right from that time, his perception of insurance changed. Rather than sit on the chair of critics, Sam became a proponent for acceptance of insurance, even for those still struggling to make ends meet. What a testimony!

I have always insisted that insurance works; even for the lowly. Whatever is worth keeping or having is worth insuring.

The insurance industry today is under better regulation and control, hence no blue murder could be committed by any operator, however highly placed. What any client needs to do is to approach those who have the competence to take them through what it entails and how to go about making claims when a loss occurs.

Those professionals are called Insurance Brokers. They are companions of insurance clients, whether small, big, individual, or corporate. They offered personalized advisory services to clients. The only reason anyone could get it wrong today insuring is only if he or she is too lazy to find out the integrity of an operator.

The industry has formidable regulatory and umbrella bodies whose duty it is to see that clients get value for their insurance. For instance, the Nigerian Insurers Association (NIA) has a website where all insurance companies in Nigeria are listed, while the Nigerian Council of Registered Insurance Brokers (NCRIB) is the umbrella body that controls and registers all insurance brokers in the country. The National Insurance Commission (NAICOM) has been saddled by the government to give regulatory oversight to the entire industry. Ignorance or withdrawal under any guise is no longer an excuse not to safeguard the risks that threaten your life, material possession, and so on in the present precarious environment in which we live. Don’t wait for it to happen before planning for it, plan for it and if it happens, you would not be licking your wounds as many around us today. Next time I promise to talk to you again about the touchy place of religion or faith when we talk about insurance. Remain insured!

Tope Adaramola is

Executive Secretary,

Nigerian Council of Registered Insurance Brokers