The Central Bank of Nigeria (CBN) has increased the capital base for commercial banks with international authorization to N500 billion and national banks to N200 billion.

This sweeping financial reform, announced on Thursday, March 28, 2024, mandates substantial increases in the minimum capital base for banks, varying by the scope of their operations.

The latest policy directive specifies that commercial banks with international authorization are now required to shore up their capital base to N500 billion.

The CBN’s Acting Director of Corporate Communications, Mrs. Hakama Sidi Ali, confirmed the policy shift in Abuja, further detailing that national authorization commercial banks need to meet a N200 billion threshold, while those with regional authorization are expected to achieve a N50 billion capital floor.

In a bid to tighten the financial fabric, the CBN has not overlooked merchant banks, which are now subject to a N50 billion minimum capital requirement.

Furthermore, non-interest banks with national and regional authorizations will need to bolster their capital to N20 billion and N10 billion respectively.

The CBN also emphasized that all banks are required to meet the minimum capital requirement within 24 months commencing from April 1, 2024, and terminating on March 31, 2026

Mega Banks (Operate all over Nigeria and Internationally) – N500 billion

Smaller Commercial Banks (Operate all over the country only) – N200 billion

Regional Banks (Operate in some parts of the country only) – N50 billion

Merchant Banks – N50 billion

Non-interest Banks (Operating all over Nigeria and internationally) – N20 billion

Non-interest Banks (Operate in the country only) – N10 billion

The new capital requirement will consist solely of paid-up capital and share premium. This means Shareholders’ Fund will not be considered.

According to the circular, to meet the minimum capital requirements, the CBN has urged banks to consider injecting fresh equity capital through private placements, rights issues, and/or offers for subscription; to pursue Mergers and Acquisitions (M&As); and/or to consider upgrading or downgrading their license authorisation.

Additionally, the circular revealed that the minimum capital will consist solely of paid-up capital and share premium. It emphasized that the new capital requirement would not be based on the Shareholders’ Fund.

“Additional Tier 1 (AT1) Capital will not be eligible for meeting the new requirement. Despite the increase in capital, banks must ensure strict compliance with the minimum Capital Adequacy Ratio (CAR) requirement applicable to their license authorisation,” the circular stated.

It added that banks falling short of the CAR requirement would be mandated to inject fresh capital to rectify their standing.

The CBN circular stated that the minimum capital requirement for proposed banks would be the paid-up capital.

The new minimum capital requirement will apply to all new applications for banking licenses submitted after April 1, 2024.

The circular also mentioned that the CBN would continue to process all pending applications for banking licenses where a capital deposit has been made and/or an Approval-in-Principle (AIP) has been granted.

Nonetheless, it stipulated that the promoters of such proposed banks must cover the difference between the capital deposited with the CBN and the new capital requirement by no later than March 31, 2026.

In the meantime, the CBN requires all banks to submit an implementation plan, clearly indicating their chosen methods for meeting the new capital requirement and detailing the various activities and their timelines, by no later than April 30, 2024.

The CBN also announced that it would monitor and ensure compliance with the new requirements within the specified timeframe.

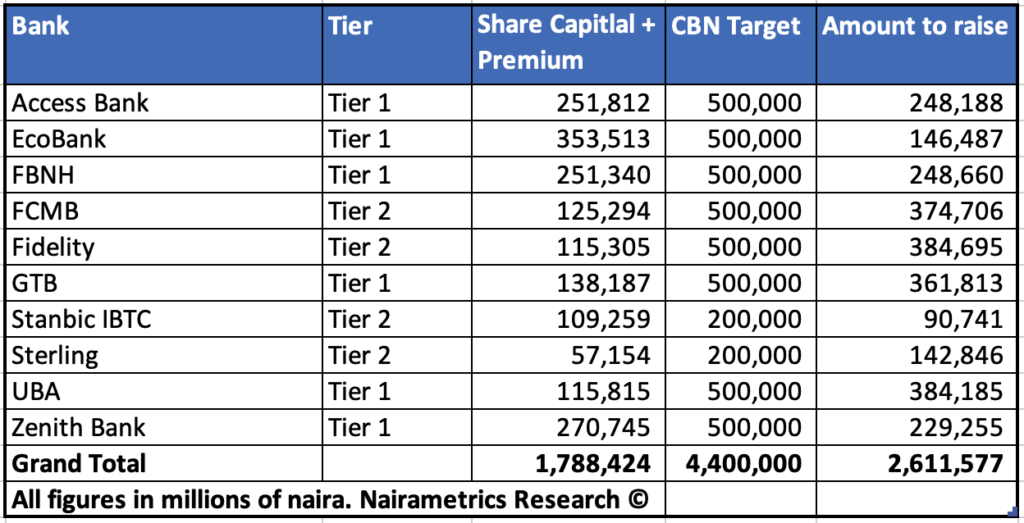

In the scenario which was based on their 2023 9 months results, we observed all the banks fall short of N500 billion capital in respect to their share premium and ordinary share capital. See below

In that scenario the table will look this way.