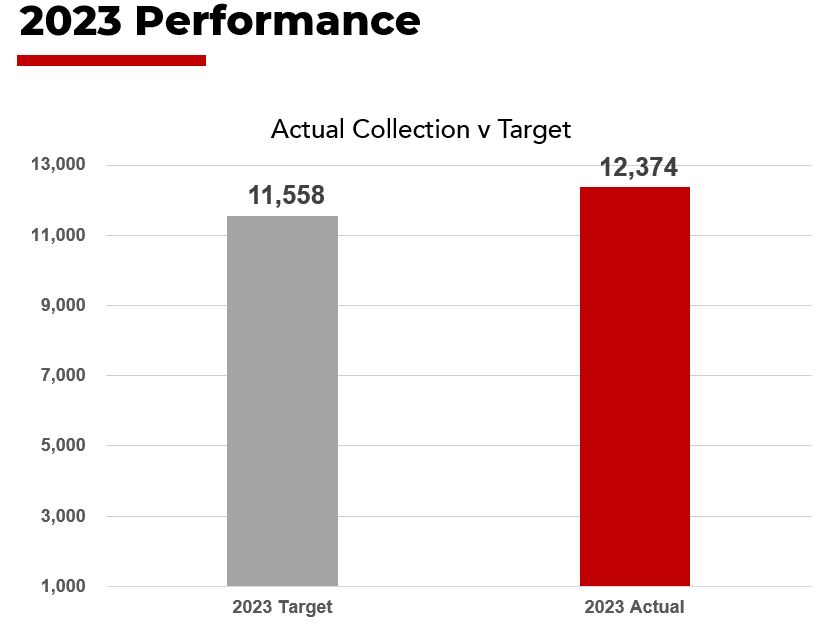

The Federal Inland Revenue Service (FIRS) has exceeded its 2023 revenue target by an N816 billion, reflecting a 107% performance over the set goal.

The total actual revenue collection for the year 2023 stood at N12.37 trillion, outperforming the N11.56 trillion target, according to a presentation document by Amina Ado, Coordinating Director of Special Tax Operations Group at the FIRS.

Source: FIRS

The agency also exceeded its 2022 revenue of N10.18 trillion by 21.7%. This collection is a part of a consistent growth pattern observed over the past few years, with the revenue figures for 2019 to 2023 being N5.262 trillion, N4.952 trillion, N6.403 trillion, N10.179 trillion, and N12.374 trillion, respectively.

CIT makes up 36.14% of 2023 taxes

Company Income tax (CIT) makes up 36.14% of the total taxes collected in 2023, making it the most collected tax for the year. It is followed by Value Added Tax (VAT) of N3.64 trillion and Petroleum Profit Tax (PPT) of N3.17 trillion.

Source: FIRS

FIRS eyes N19.41 trillion revenue in 2024

The Federal Government expects N19.41 trillion revenue from the FIRS in 2024. This target represents a significant increase of 56.91% from the previous year’s actual and 67.91% from the previous year’s target.

Source: FIRS

The data shows that the Federal Government expects more taxes from the oil sector, about N9.96 trillion this year. This is about 214.2% of what was generated from this form of tax last year.

The sustained growth in revenue collection is largely attributed to FIRS’s administrative reforms, such as the automation of tax collection processes, introduction of TaxPro-Max, and use of third-party data for enhanced tax intelligence. Policy reforms have also played a significant role, including the increase in VAT and Education Tax rates and improvements in tax laws through Finance Acts.

Despite these achievements, FIRS acknowledges the challenges ahead, particularly in the face of global economic uncertainties, fluctuating oil prices, and internal resistance to change. However, the agency remains resolute in its commitment to national duty, aiming to silence doubts and confidently declare its capability to meet and exceed its targets.

Speaking on Wednesday in Abuja at the 2024 strategic management retreat of FIRS, its Executive Chairman, Zacch Adedeji, said the target is achievable with the series of reforms being implemented by the Service.

And what we’ve done in general is to move from functional or type of taxi units to customer-centred.

“And we want to use that to drive compliance because the focus cannot be on investigation. The real strategy is to drive compliance and the way to do it is that there will always be consequences for no compliance.

“So, our focus is not to go and tax the informal sector. Our focus is actually to bring the informal sector to the sector. The focus should not be let’s go and tax informal. The focus should be to move the informal sector to the formal sector, improve their skill and then we can then tax them.”

He added that the new operational structure that is being established at the agency will eliminate confusion and redundancy in tax administration in Nigeria.