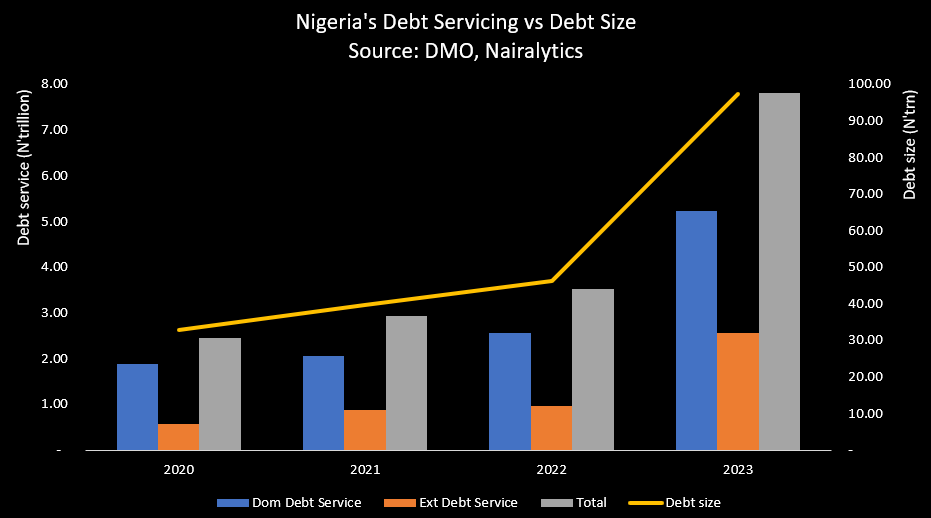

Nigeria spent a sum of N7.8 trillion to service its debt obligations in 2023, a 121% increase compared to N3.52 trillion incurred in the previous year.

This is according to analysis of data released by the Debt Management Office (DMO).

The breakdown of the data shows that domestic debt service cost stood at N5.23 trillion, representing a 104% increase from the previous year’s N2.56 trillion, while external debt service surged by 167% to N2.57 trillion, compared to N962.5 billion recorded in 2022.

The significant jump in Nigeria’s debt service cost was partly due to the devaluation of the local currency, which drove the cost of servicing foreign debt obligations as the CBN grappled with FX liquidity crisis and exchange rate volatility.

The prevailing exchange rate for the quarterly periods as provided by the DMO were used to convert the external debt cost from dollar to naira.

It is worth noting, that the debt service cost in the review year, surpassed the N6.56 trillion that was earmarked for the year. According to the budget document obtained from the Budget Office, the federal government had budgeted N6.56 trillion for debt servicing, which is made up of N3.29 trillion (domestic), N1.81 trillion (external), N247.7 billion (sinking fund), and N1.2 trillion as interest on Ways & Means debt to the CBN.

Nigeria continues to grapple with dwindling revenue amidst rising fiscal expenditure, with debt servicing gulping a huge chunk of government budget. According to data from the Budget Office, debt servicing accounted for 45.6% of its total expenditure between January and September 2023.

Also, compared to revenue generated in the same period, debt service gulped about 80.9% of the total federal government revenue in the nine months period. Notably, retained revenue stood at N7.51 trillion while debt service as of September 2023 was N5.79 trillion.

More borrowings amidst widening budget deficit

The Nigerian government is set to increase its borrowings in 2024, on the back of an over N10 trillion budget deficit, after President Bola Tinubu signed the 2024 budget of N28.7 trillion, with a projected revenue of N18.32 trillion for the period.

So far in 2024, the CBN on behalf of the federal government has already raised about N2.05 trillion through Treasury Bills auctions, while the Debt management Office raised over N2 trillion from bond auctions between January 2024.

Meanwhile, the federal government is currently in talks with the World Bank to complete the process of obtaining about $1 billion loans in a bid to address the challenges facing Internally Displaced Persons (IDPs), and their host communities as well as bolster rural access and agricultural marketing in the country.

In the same vein, the federal government has reportedly hired investment banks including Citigroup, JPMorgan Chase & CO, as well as Goldman Sachs Group to advise on a Eurobond issue later in the year. Although, the size of the Eurobond offer is still unknown, this would significantly increase Nigeria’s debt profile by the end of the year, contributing to an increase in its debt service cost.

Although the federal government proposed a debt service expense of N8.25 trillion for the 2024 fiscal year, accounting 28.7% of the total proposed budget for the year.

The DMO also announced a 110% increase in the nation’s total debt stock from N46.25 trillion recorded as of the end of 2022 to N97.34 trillion by 31st December 2023, a staggering increase of N51.1 trillion in the space of one year.

Federal government domestic debt stood at N53.26 trillion, while the 36 states including the Federal Capital Territory owe N5.86 trillion domestically, summing up to N59.12 trillion.

On the other hand, federal government external debt as of the end of December 2023 was N34.07 trillion, states owe a sum of N4.15 trillion, bringing the total external debt stock to N38.22 trillion.