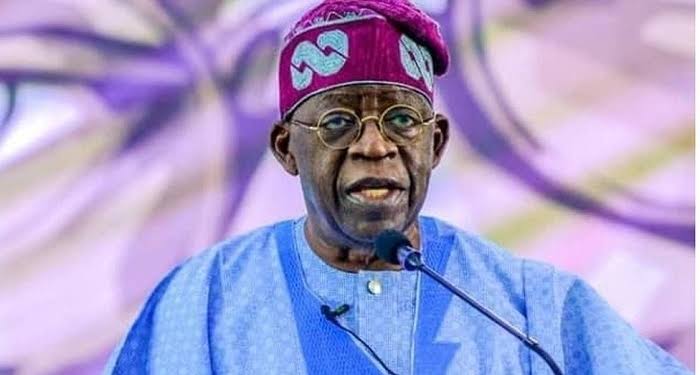

Nigeria secured total loans of $2.7 billion from the World Bank under the administration of President Bola Tinubu amid concerns over the country’s rising external debt servicing costs.

The four approved loans are for power ($750 million), women empowerment ($500 million), girl’s education ($700 million), and renewable energy ($750 million), according to findings.

$750 million loan for power sector: The first was approved on June 9, 2023, with a loan of $750 million to boost Nigeria’s power sector. The World Bank said the loan would serve as additional financing for the power sector recovery performance-based operation.

$500 million for women’s empowerment: On June 27, the World Bank Group announced the approval of a loan of $500 million to help Nigeria drive women’s empowerment. This was the second loan approved by the bank under Tinubu’s administration. It provided a scale-up financing for the Nigeria for Women Programme.

$700 million for educating adolescent girls: In September 2023, the World Bank approved a loan of $700 million to bolster educational opportunities and empowerment for adolescent girls in Nigeria. The loan was to support the ongoing ‘Adolescent Girls Initiative for Learning and Empowerment’ (AGILE) project. It aimed to encourage secondary education accessibility for girls residing in specific target states within Nigeria.

$750 million for renewable energy: On December 14, the World Bank approved the $750 million Distributed Access through Renewable Energy Scale-up (DARES) project in Nigeria. The project aims to provide over 17.5 million Nigerians with better access to electricity via distributed renewable energy solutions and tackle the electricity access deficit.

The World Bank recently disclosed that Nigeria was the top recipient of its fresh loans in 2022, with about $2.9 billion released to the country. According to its International Debt Report for 2023, Nigeria was followed by Tanzania, which got $2.7 billion in the same year.

“Nigeria and Tanzania were the top recipients of new financing from the World Bank in 2022, at US$2.9 billion and US$2.7 billion, respectively.”

So far, the World Bank has approved to Nigeria in 2023 the total loan received by Tanzania in 2022.

Data from the external debt stock report of the Debt Management Office (DMO) shows that Nigeria owes the World Bank a total of $14.58 billion as of September 30, 2023.

There have been concerns over the country’s rising debt costs amid rising debt over the years.

Nigeria spent about 277.64% more servicing its external debt in the third quarter of 2023.

The DMO in a statement said that external debt decreased due to the redemption of a $500 million Eurobond and payment of $413.859 million as the first principal repayment of the $3.4 billion loan obtained from the International Monetary Fund (IMF) in 2020 during Covid-19.

However, it appears that there is no record of the debt service to the IMF in the external debt servicing report of Q3 2023.

In a recent statement by the World Bank, it stressed the impact of high debt service costs on developing countries, with its Chief Economist and Senior Vice President, Indermit Gill, saying:

“The situation warrants quick and coordinated action by debtor governments, private and official creditors, and multilateral financial institutions more transparency, better debt sustainability tools, and swifter restructuring arrangements. The alternative is another lost decade.’’